Collection of Frameworks and Processes for Product and Technology Management

There are numerous frameworks, processes and tools that are used in the domain of product and technology management. These are just a small subset which are applicable as a background to my articles.

There are numerous frameworks, processes and tools that are used in the domain of product and technology management. These are just a small subset which are applicable as a background to my articles.

- Porter’s Five Forces and STEEP forces

- Porter’s Generic Value Chain

- Value Delivery System

- Customer Life Cycle or Buyer Experience Cycle

- Lean Thinking

- Customer Relationship Life Cycle

- Product life cycle, technology maturity and adoption

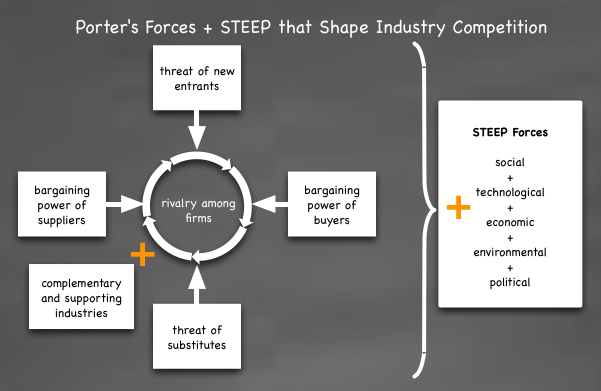

Porter’s Five Forces and STEEP forces

Porter’s five forces framework is a starting point for analyzing the attractiveness of your market. The interrelationship between the four external actors (potential new entrants, potential substitutes, buyers and suppliers) and the rivalry between the firms within the industry forms the five competitive forces. In summary, the greater the strength of the competitive forces, the higher the intensity of the competition and less profit potential.

- The threat of new entrants into the industry — potential entrants reflect the firms that are not yet in your market, but potentially could be lured in for various reasons, usually related to the similar factors as outlined in the ‘intensity of rivalry’ (below). However, these potential new entrants have to deal with several entry barriers:

- economies of scale that maybe available to large incumbents;

- experience curve effects already benefitting the existing competitors;

- access to channels & complementary assets;

- The threat of substitutes for the industry’s products or services — these are alternative yet similar solutions. Factors influencing the threat of substitution also effects the potential entrants as well as the existing competition among the firms. Additional attributes to consider are:

- buyer’s switching costs to the substitute;

- relative price/performance, and how fast it is improving in the substitute’s industry;

- The bargaining power of buyers of the industry’s products or services — this represents the relative relationship between the firm and its customers. The factors effecting the buyer’s bargaining power is similar to the factors influencing the suppliers.

- buyer concentration;

- buyer’s switching costs;

- threat of backward integration: buyer set up subsidiaries that produce some of the inputs used in the production of its products;

- The bargaining power of suppliers of products or services to the industry — this measures how much a supplier can raise prices without the firm retaliating or switching suppliers. Suppliers include material and component suppliers, as well as skilled labor, technology, software and other inputs to the final product/service. The factors influence the supplier’s bargaining power are:

- importance of the factor to the user: the more important the given component/factor to the user, the more likely the firm has to accept unfavorable terms;

- supplier concentration: the fewer the suppliers, the more bargaining power the supplier has; firm’s switching costs: the higher the switching costs, the less likely the firm will switch suppliers;

- threat of forward integration: if the supplier can enter the buyer’s industry with its own competitive product, it has additional bargaining power;

- The intensity of rivalry among firms in the industry;

- growth rate of the market: slow-growth markets may increase intensity of competition among existing competitors;

- number of competitors: the more contenders, the more intense the competition;

- buyer’s switching costs: low switching costs make it easier for competitors to steal each other’s customers;

- firm’s exist costs: the higher exit costs, the more likely the firms will stay in;

- brand loyalty: less brand loyalty, more likely buyer’s will switch vendors;

- buyer’s price sensitivity: the more price sensitive the customers are, the more likely lowering price would entice customers’ to switch vendors;

- ability to differentiate: fewer opportunities for differentiation indicates less likely to keep existing customers’ loyalty;

Complimentary and Supporting Industries is added as the Sixth Force to Porter’s model. A product’s complements enable its users to experience the full benefits of the product, such as the iPod and its infinite number of accessories. An industry with easy access to related and supporting industries may benefit from cross-compilation of ideas, common pool of technical talent, opportunities for joint innovation, and opportunities to share infrastructure and/or distribution channels. These opportunities can enable creative and innovative linkages with the complementer to further differentiate your product. However, at the same time, the threat comes if the complementer becomes a new entrant by integrating the offer into their product, thereby becoming a competitor.

We can further Porter’s forces by looking at the external forces that impact the business environment utilizing STEEP forces analysis (Social, Technological, Economic, Environmental, Political).

- Social —what are the current trends in the communities and relationships, and how the industry and technology influences those trends, such as: demographic factors (population distribution, age distribution, education and income levels), attitudes towards capitalism, individualism, environmentalism, church and religion, health and nutrition;

- Technological — what are the technological changes and their potential impacts, what is the efficiency of the infrastructure (transportation, education, health care, communication, etc.), cost and accessibility to power, new technologies, manufacturing processes and overall industrial productivity;

- Economic — how are the economics changing in the industry, such as: economic growth, unemployment and inflation rates, consumer and investor confidence, currency exchange;

- Environmental — what are the environmental trends and influences: impacts to firm’s production processes, affects on customers’ buying habits, perception of the company or product;

- Political — what is the political climate, its stability and risk, what are the various government policies and mandates, export restrictions, taxes and tax breaks, copyright and patent laws, environmental protection laws, union laws;

You can assess the impact of these forces using a range of –/++ to show how favorable (++) or unfavorable (- -) a given force is. You can also do further sensitivity analysis on your findings and by exploring what ifs: what if a given force changes by X value, or what would it take to make a given factor favorable? You can also funnel these learnings to your strategic plans and risk management activities. Again, the speed that your business environment is changing should dictate the frequency of this activity. For emerging and highly turbulent markets, you should consider putting in place a continuous environmental scanning process.

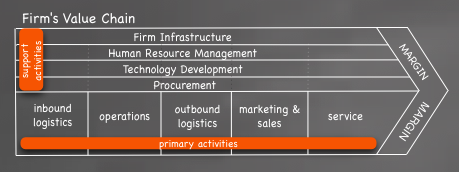

Porter’s Generic Value Chain

Michael Porter introduced the concept of generic value chain model that describes a sequence of activities that are common to a range of firms. As shown in the figure, a value chain includes all the activities a product goes through, which also adds value to the product.

Note that the activities in the value chain is also linked. High quality assurance processes during technology development reduces the support/service costs in the field. This is also true from the perspective of procurement, where high quality assurance processes eliminate faulty parts, reducing the costs associated with debugging and maintenance later in the value cycle.

Note that no two firms, even in the same industry, making the same products, have identical value chains. So, how well a firm manages its value chain and its linkages determines the value they deliver and competitive advantage they gain in the industry.

Value Delivery System

Porter’s value chain concept can be extended beyond just an organization to describe the value systems. A value system includes the value chains of all the ecosystem players that collaborates to deliver value to the customers.

Think about the challenges of working with other internal groups in your company, and project it to your ecosystem of partners, suppliers, alliances and all. Don’t forget to factor in the cultural and value differences as well as conflicting priorities and goals. However, a firm’s position in this value delivery system will again differentiate it from the rest of the pack.

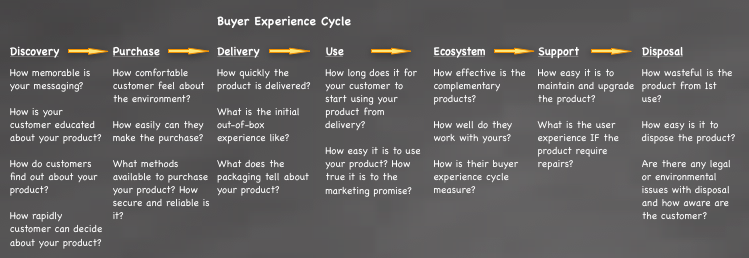

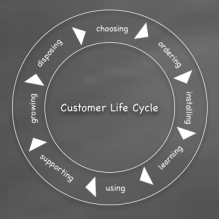

Customer Life Cycle or Buyer Experience Cycle

Customer life cycle describes the steps a customer goes through when selecting, purchasing, using, and all the way through disposing of a product or a service. As simple as it sounds, getting a potential customer’s attention in these days is a challenge. Given the availability of competing options and transparency of product information/reviews, firms need to pay extra attention to capturing the potential customers and turning them into paying and loyal customers.

Lean Thinking

Lean principles derived from Japanese manufacturing industry. The focus is the removal of waste while adding value. Rather than a one time activity, lean is a continuous cycle of process improvement.

Lean principles:

- Define value from the perspective of the customer.

- Identify value stream by mapping out all the activities involved in the product and service that adds value.

- Create flow by eliminating waste and reorganizing processes so the product or service flows through all the value adding steps in the most effective and efficient way.

- Produce to customer pull by delivering what your customer needs, when and where they need it.

- Strive for perfection by continuously evaluating your processes and adopting to the changing needs and demands of your customers.